MyTrueIdentity is a credit monitoring and identity protection service offered by TransUnion, one of the three major credit reporting agencies in the United States.

Designed to help users safeguard their personal information, monitor changes to their credit reports, and prevent identity theft, MyTrueIdentity is generally considered a legitimate service. However, some users have raised concerns about scams or fraudulent activity using the MyTrueIdentity name, leading to confusion about the service’s credibility. This article explores whether MyTrueIdentity is a scam, common issues users report, and how to protect yourself from fraud.

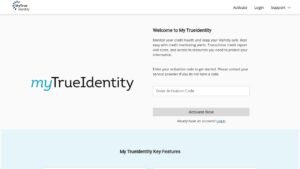

What is MyTrueIdentity?

MyTrueIdentity provides a suite of features to help individuals protect their personal information and monitor their credit activity. Key services include:

- Credit Monitoring: Alerts for changes to your TransUnion credit report, such as new accounts or inquiries.

- Identity Theft Insurance: Coverage of up to $1 million for costs associated with identity theft recovery.

- Credit Lock/Unlock: The ability to lock and unlock your TransUnion credit file to prevent unauthorized access.

- Fraud Support: Access to fraud specialists for resolving identity theft issues.

- Credit Reports and Scores: Regular access to TransUnion credit reports and VantageScore credit scores.

While the service itself is legitimate, scammers have been known to impersonate MyTrueIdentity to steal sensitive information or money from unsuspecting individuals.

How Scammers Exploit MyTrueIdentity

Fraudsters often exploit the trusted reputation of services like MyTrueIdentity to deceive victims. Common tactics include:

1. Phishing Emails

Scammers send emails claiming to be from MyTrueIdentity or TransUnion, urging recipients to click on a link to resolve a supposed issue with their credit report or account. These links lead to fake websites designed to steal login credentials, Social Security numbers, or payment information.

2. Fake Customer Support Calls

Imposters may call individuals pretending to be representatives from MyTrueIdentity, asking for personal information under the guise of verifying an account or investigating potential fraud. Legitimate representatives will never ask for sensitive details over the phone.

3. Data Breach Exploitation

After a data breach, scammers may pose as MyTrueIdentity offering free credit monitoring services. Victims of breaches are often provided genuine MyTrueIdentity accounts by TransUnion, but fraudsters use this opportunity to send fake sign-up links.

4. Subscription Scams

Some users have reported unauthorized charges on their accounts, believing they’ve been enrolled in MyTrueIdentity without their consent. While these cases may stem from misunderstandings or third-party resellers, it’s crucial to verify the source of any subscriptions.

Read also: SamplesHaul.com Review: Is the $750 Costco Gift Card a Scam?

Is MyTrueIdentity a Scam?

MyTrueIdentity itself is not a scam. It is a legitimate service operated by TransUnion and provides genuine credit monitoring and identity protection. However, scams impersonating MyTrueIdentity can cause confusion and lead to financial loss or identity theft.

How to Protect Yourself from MyTrueIdentity Scams

1. Verify Communication Sources

Always confirm the sender’s email address. Official emails from MyTrueIdentity will come from TransUnion’s domain (e.g., “@transunion.com”).

Do not click on links in unsolicited emails. Instead, visit TransUnion’s official website directly to access your account.

2. Be Wary of Phone Calls

If you receive a call claiming to be from MyTrueIdentity, do not share personal information. Hang up and contact TransUnion directly using their official customer service number.

3. Monitor Your Financial Accounts

Regularly check your bank and credit card statements for unauthorized charges. Report any suspicious activity immediately.

4. Use Strong Passwords

Protect your MyTrueIdentity account with a unique, strong password and enable two-factor authentication if available.

5. Report Suspicious Activity

If you suspect you’ve been targeted by a scam, report it to TransUnion, the Federal Trade Commission (FTC), or your local consumer protection agency.

Read also: The Angela Rettmann PayPal Money Request Scam: What You Need to Know

What to Do If You’ve Been Scammed

If you believe you’ve fallen victim to a MyTrueIdentity-related scam, take the following steps immediately:

- Contact TransUnion: Notify TransUnion about the incident to secure your account and investigate unauthorized activity.

- Monitor Your Credit Reports: Check your credit reports for unauthorized accounts or inquiries. You can do this through AnnualCreditReport.com or directly with the credit bureaus.

- Freeze Your Credit: Place a credit freeze with TransUnion, Equifax, and Experian to prevent new accounts from being opened in your name.

- Report the Scam: File a report with the FTC at identitytheft.gov and your local law enforcement.

- Secure Your Accounts: Change passwords for your online accounts and enable two-factor authentication wherever possible.

Legitimate Features of MyTrueIdentity

For users who have access to the real MyTrueIdentity service, it can be a valuable tool for monitoring and protecting credit information. Here are some legitimate benefits:

- Real-Time Alerts: Notifications of changes to your TransUnion credit report.

- Identity Theft Insurance: Financial protection for costs associated with recovering from identity theft.

- Fraud Resolution Support: Assistance from dedicated specialists to resolve credit or identity issues.

- Free Access for Breach Victims: Many organizations offer free MyTrueIdentity accounts to individuals affected by data breaches.

Read also: Postcode Lottery Scam: What You Need to Know and How to Protect Yourself

Conclusion

While MyTrueIdentity is a legitimate service offered by TransUnion, scammers often exploit its name to target unsuspecting individuals. To protect yourself, always verify communications, avoid sharing personal information with unsolicited contacts, and monitor your financial accounts for suspicious activity. By staying vigilant and taking proactive steps, you can safeguard your identity and avoid falling victim to these scams.

If you’re unsure about the authenticity of a message or request, contact TransUnion directly and report any suspicious activity. Remember, protecting your personal information is the first line of defense against fraud.

Leave a comment